are delinquent property taxes public record

If the property owner fails to pay the delinquent taxes within two years from the date of delinquency the tax certificate holder may file a Tax Deed Application TDA per Florida. Butte County Treasurer 117 5th Avenue Belle Fourche SD 57717 2021 payable 2022 property taxes are now available.

Secured Property Taxes Treasurer Tax Collector

If your unpaid taxes have been sold at an annual tax sale scavenger sale or over the counter the Clerks office can provide you with an Estimate Cost of Redemption detailing the amount.

. A tax lien is simply a claim for taxes. Finds and notifies taxpayers of taxes owed. First ½ becomes delinquent on May 1 2022.

Provide Tax Relief To Individuals and Families Through Convenient Referrals. Typically a tax lien is placed on the property by the government when the owner fails to pay the property. Delinquent tax records are handled differently by state.

The Tax Office accepts full and partial payment of property taxes online. Have not paid their taxes for at least 6 months from the day their. They are then known as a certificate of.

Seizes property for non-payment in. Thats the key to this real. HOW TO PAY PROPERTY TAXES.

By Mail - Check or money. At the close of business on April 15th the tax bills are transferred from the sheriffs office to the county clerks office. For an official record of the account please visit any Tax Office location or contact our office at 713-274-8000.

It is recommended that a tax claims search be conducted in the same time period as a real estate closing to minimize any potential problems or miscalculations. To see if your taxes have been sold forfeited or open for prior years currently defined as 2019 and earlier please enter your property index number PIN in the search box below. The Milwaukee County Treasurers online inquiry and payment system allows customers to search view and pay delinquent property taxes online.

Certain Tax Records are considered public record which means they are available to the. To read an explanation of why your property taxes may have increased please click here. Its public record too.

When property taxes go unpaid or are delinquent for a period of time this is recorded by the tax assessor or tax collector. Ad Based On Circumstances You May Already Qualify For Tax Relief. 105-3651 b 1.

Are Irs Tax Liens Public Record. A prior owner who was not the record owner as of January 6 may not be held personally responsible for taxes on the real property in question. All taxpayers on this list can either pay the whole liability or resolve the liability in a way that satisfies our conditions.

The Delinquent Tax office investigates and collects delinquent real property taxes penalties and levy costs. Failure to redeem the property within this time period will result in tax foreclosure and the sale of the property at auction. Ad Uncover Available Property Tax Data By Searching Any Address.

If a legal claim is made against your property in order to satisfy a tax debt the IRS will file a. Ad Looking for Corinth Tax Records. The building closes to the public at 415PM.

For Reno County such sales usually occur in the fall of each year. Lytle St Suite 5101 Murfreesboro TN 37130 email protected. Tax Records include property tax assessments property appraisals and income tax records.

Property taxes not paid to the. Get In-Depth Property Reports Info You May Not Find On Other Sites. In Person - The Tax Collectors office is open 830 am.

A New Jersey tax lien certificate transfers all the rights that come with being the owner of the real estate tax lien from Middlesex County New Jersey to the. Mail all documentation to. The Wayne County Treasurers Office is responsible for collecting delinquent taxes on Real Property located within Wayne County.

Records on this site. We Provide Homeowner Data Including Property Tax Liens Deeds More. Ad Based On Circumstances You May Already Qualify For Tax Relief.

How Do Doordash Drivers Pay Taxes. Provide Tax Relief To Individuals and Families Through Convenient Referrals. Monday - Friday 800AM - 430PM.

Ad View Your Homes Appraisal Value Suggested Listing Price - Fast and Free.

Understanding Your Tax Bill Seminole County Tax Collector

One Of The Steps In Buying A Home Is To Have A Title Search Completed Prior To Closing Many First Time Buyers May Not Have H Title Insurance Title Home Buying

Everything You Need To Know About Getting Your County S Delinquent Tax List Retipster

Charlotte Foreclosure Notice Sell House Fast Sell House Fast Foreclosures Selling House

How To Read Your Property Tax Statement Snohomish County Wa Official Website

Property Taxes Department Of Tax And Collections County Of Santa Clara

Real Estate And Personal Property Tax Unified Government Of Wyandotte County And Kansas City

2022 Property Taxes By State Report Propertyshark

How To Perform A Property Records Search In California We Lease San Diego

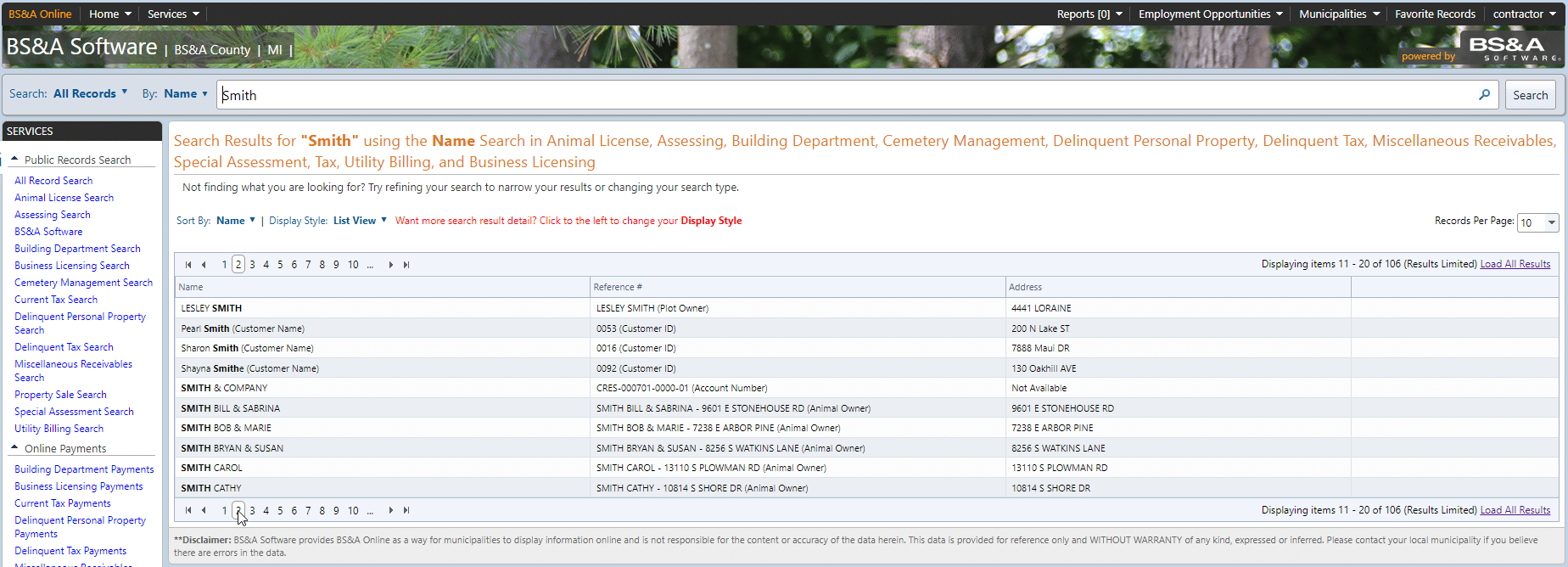

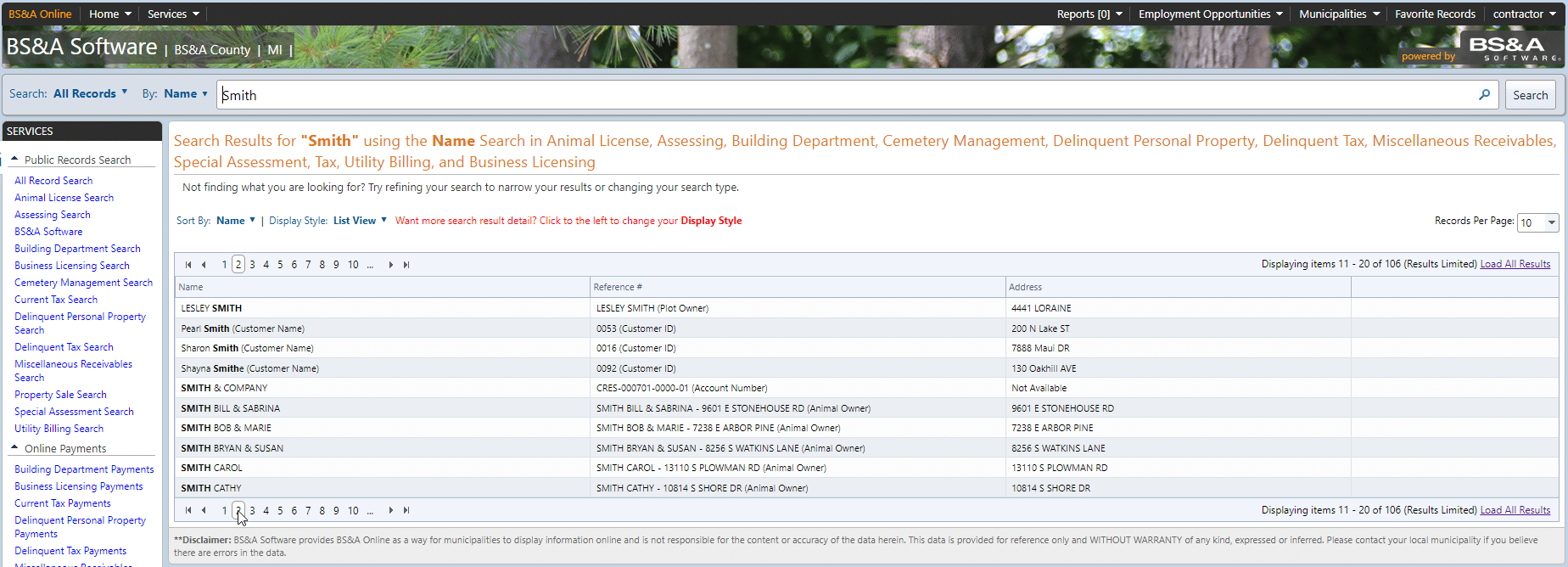

Bs A Online Services Public Records Search Bs A Software

Frequently Asked Questions Treasurer

How Can I Find Out If Someone Paid Their Property Taxes Nj Com

Delinquent Property Tax Owners Will Be Listed In The Charlotte Observer

How To Read Your Property Tax Statement Snohomish County Wa Official Website